The financial competence of Latvian 15-year-old students corresponds to the average level of the Organization for Economic Co-operation and Development (OECD) countries, according to the latest results of the Programme for International Student Assessment (PISA) 2018.

Results of the Latvian students in financial competence – unchanged; the new approach to curricula will make its contribute thereto

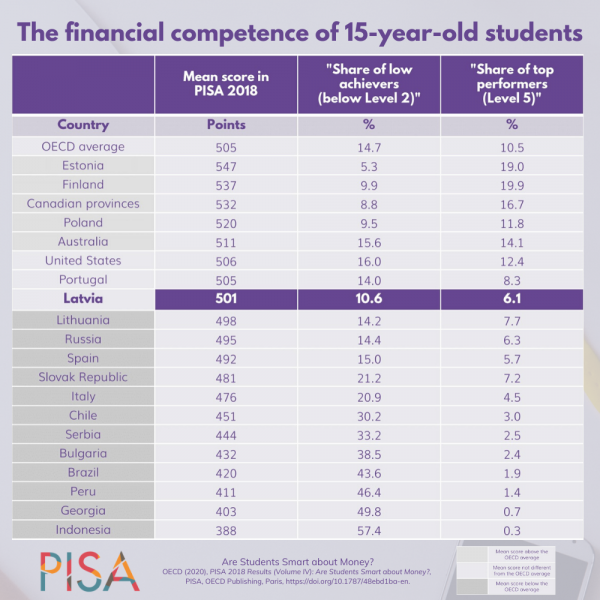

Out of a total of 20 OECD countries and partner countries, whose students participated in the 2018 financial competence module, the Latvian students rank 8th with a result of 501 points. This is in line with the OECD average level. The highest performance in financial competence was shown by the Estonian students, followed by teenagers from Canada and Finland. In these countries, student achievement in financial literacy was significantly higher than the OECD average.

Gunta Arāja, Deputy State Secretary of the Ministry of Education and Science, points out: “The achievements in financial competence of the Latvian students in this cycle of the PISA survey have not changed significantly compared to the previous measurement in 2012, however, our goal is to improve this indicator, including by increasing the proportion of those who achieved the highest results. In the opinion of the Ministry, the introduction of the competence approach in the curriculum of general education is a significant contribution in achieving this goal. ”

Andris Kangro, PISA National Project Manager, Professor of the University of Latvia, emphasizes that “the financial competence of 15-year-old Latvian students corresponds to their achievements in all other fields of study – we are at or close to the OECD average. To some extent, it is surprising that parents play a very positive role in informing students and their achievements in financial area”.

In Latvia, the highest result (competence level 5) in the financial competence test was obtained by 6.1% of the students, while in Estonia it was 19%. The number of such students was even higher only in Finland – 19.9%. Low achievements (below the 2nd competence level) were shown by 10.6% of students in Latvia, 5.3% in Estonia, but on average – 14.7% in OECD countries.

International results show that boys, on average, have slightly better financial performance than girls. Girls and boys living in socially and economically favourable families also have better competencies, however, the impact of the socio-economic status of the Latvian families on student achievement is lower than the OECD average. Thus, our education system is to some extent able to compensate for the impact of the unfavourable socio-economic situation of the family on the student's achievements.

80% of Latvian students feel responsible for their own money matters

The latest PISA 2018 volume also focuses on students' financial habits and attitudes towards money. Students who are safe and confident users of digital financial services also achieve better financial literacy.

59.4% of the surveyed students in Latvia have a bank account, but 53.3% – also a payment card. In Estonia, the proportion of these students is 59.2% and 75.2%, respectively, while in OECD countries the average is 53.5% and 45.4%. The average number of students who purchased goods or services online (alone or with parents) in the 12 months before participating in the study was 72.6% in OECD countries. This proportion of students was also in Estonia, while 76.5% of students had such experience in Latvia.

In OECD countries, on average, 66.7% of students feel confident and secure when making payments with payment cards. Students of Latvia form almost the same share – 66.6%, while in Estonia it is 72.2%. In OECD countries, an average of 81.3% of students consider themselves responsible for their own financial matters and security of funds. In Latvia, Lithuania and Estonia, the share of such students is almost the same – 81.7%, 81.8% and 82.2%, respectively.

The main source of information for students on financial matters is their parents or children's legal representatives, according to an average of 94.4% of students in OECD countries. In Latvia, Lithuania and Estonia, the share of such students is very similar – 94.7%, 93.8% and 94.5%, respectively. The study reveals the role of parents in matters of financial competence: in all OECD countries, students whose source of information in monetary matters is mainly parents outperform their peers in financial competence.

Citizens' financial competence is even more important today

Many young people make financial decisions and are already consumers of financial services. As adults, they face increasing complexity and risks in the financial market. Better knowledge and understanding of financial concepts and risks helps to improve financial decision-making, which is why financial literacy is now recognized worldwide as an essential life skill.

Finally, the indirect impact of the Covid-19 situation on individuals' incomes and savings (both current and future) and the increased uncertainty in the economic and financial environment make financial competence even more important, as this skill must ensure the financial stability of the population.

Volume 4 of the OECD PISA 2018 study on students' financial competence (in English).

Thirteen OECD countries and economies and seven partner countries participated in the PISA 2018 International Student Assessment Program. About 117,000 15-year-olds took part in the tests. Latvia was represented in the study by 5,985 students from 308 schools.

Financial competence in the context of PISA is knowledge and understanding of financial concepts and risks, and the skills, motivation and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life.

The implementation of PISA 2018 in Latvia takes place in cooperation with researchers from the Educational Research Institute of the Faculty of Pedagogy, Psychology and Art of the University of Latvia. The study is taking place in the European Social Fund project No. 8.3.6.1/16/I/001 “Participation in international education studies”.

Additional information: Aivis Majors, Project Communication Coordinator of the Policy Initiatives and Development Department, Ministry of Education and Science, aivis.majors@izm.gov.lv